Michael Joseph has officially retired as Chairman of Kenya Airways PLC (KQ), concluding a nine-year tenure that began in October 2016. His departure, effective June 13, 2025, was confirmed by the airline’s board pursuant to regulatory requirements under the Capital Markets (Securities) (Public Offers, Listing and Disclosures) Regulations 2023. The exit aligns with the term limits stipulated in Kenya Airways’ Board Charter. His retirement also comes shortly after KQ shares resumed trading on the Nairobi Securities Exchange and regional bourses in Uganda and Tanzania, after a suspension of more than four years to pave the way for the restructuring of the company, including a proposed State-takeover through a nationalisation process.

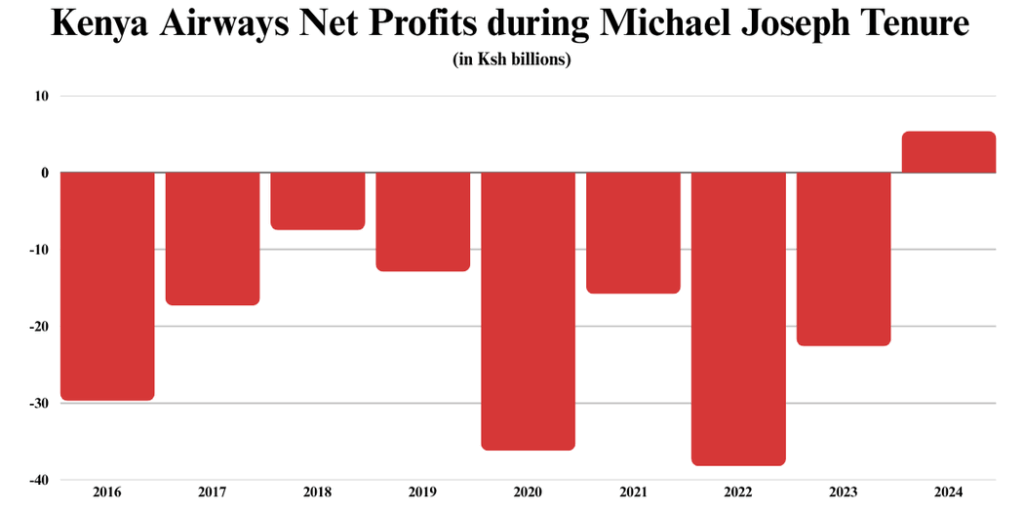

Joseph, best known for transforming Safaricom into one of Africa’s most successful telcos, joined Kenya Airways at a time when the airline was reeling from years of financial losses and mounting debt. In 2016, Kenya Airways (KQ) saw a record KSh 26 billion loss, which was the largest in Kenya’s corporate history at the time. This loss occurred despite efforts to implement a restructuring plan called “Operation Pride” that aimed at turning the airline’s finances around.

His leadership coincided with persistent external shocks, including terrorism-related tourism declines, high fuel costs, currency volatility, and ultimately, the COVID-19 pandemic. Amid this environment, he spearheaded multiple phases of restructuring aimed at stabilizing the national carrier.

- Most Valuable Brands in Kenya 2025

- Peter Ndegwa Appointed Safaricom Ethiopia Advisory Board Chairman

The most notable outcome of Joseph’s tenure was the KSh 5.4 billion net profit reported in 2024, Kenya Airways’ first profit in over a decade. This turnaround came after the airline posted a KSh 22.6 billion loss in 2023. Passenger numbers grew 4% year-on-year to reach 5.23 million in 2025, while cargo volumes jumped 25% to over 70,000 tonnes. These improvements were supported by increased travel demand, improved fleet utilization, and network optimization. Kenya Airways Cargo was also named “Highly Acclaimed African Air Cargo Airline of the Year” at the 2025 Air Cargo Africa Conference.

Under Joseph’s direction, the airline launched a five-year plan that included expansion into new markets, such as direct flights to the United States, the reduction of unprofitable routes, and a renewed focus on cargo and ancillary revenue streams. These operational shifts were crucial to improving revenue and reducing losses. By 2025, passenger revenue had risen to KSh 156 billion, bolstering the airline’s income base. Kenya Airways also earned multiple accolades during this period, including being named “Africa’s Leading Airline – Business Class” multiple times and receiving the “Best Improved Profitability” award from the African Airlines Association (AFRAA) in 2023.

However, challenges remained. Despite the profit in 2024, Kenya Airways continued to face serious financial constraints. Joseph himself admitted that the airline does not generate enough internal cash flow to fund expansion. The carrier remains heavily reliant on government-backed debt restructuring. In 2023, KQ avoided direct bailouts but benefited from debt conversion and restructuring, including previous measures such as the 2017 debt-to-equity swap. At the time of Joseph’s departure, the government still owned 48.9% of the airline.

Labor relations were another source of pressure. In 2016, the Kenya Airline Pilots Association (KALPA) called for leadership changes amid declining performance. Though the dispute was resolved, labor unrest resurfaced in 2022 with a costly strike that resulted in over KSh 1.3 billion in losses.

While the return to profitability was a major achievement, Joseph leaves at a time when Kenya Airways is still navigating structural weaknesses. The ongoing search for a strategic investor, set in motion under CEO Allan Kilavuka, is aimed at reducing debt and supporting future expansion. Whether this investor materializes will significantly affect the airline’s next chapter, but it also introduces new risks depending on ownership structure and terms.

Joseph’s exit from KQ follows his resignation as Chairman of Safaricom Ethiopia in May 2025, in addition to stepping down from the board of Safaricom in August 2023.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.