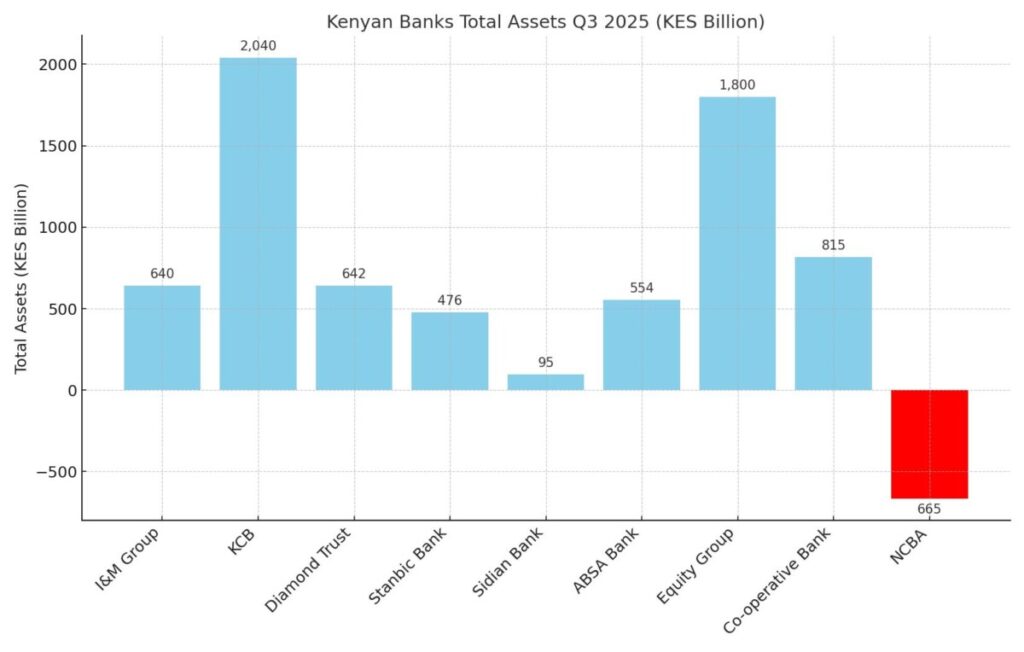

Eight Kenyan banks posted growth in total assets during the third quarter of 2025, with I&M Group leading the surge at 12.7%, reaching KES 640 billion.

KCB’s assets rose 2.6% to KES 2.04 trillion, Diamond Trust Bank increased 8.7% to KES 641.7 billion, Stanbic Bank Kenya grew 3% to KES 476.2 billion, Sidian Bank surged 66.4% to KES 95 billion, ABSA Bank rose 14.4% to KES 554.3 billion, Equity Group’s assets grew 6.7% to KES 1.8 trillion, and Co-operative Bank of Kenya expanded 8.6% to KES 815.3 billion. NCBA Group was the only lender to see a slight dip of 2% to KES 665 billion.

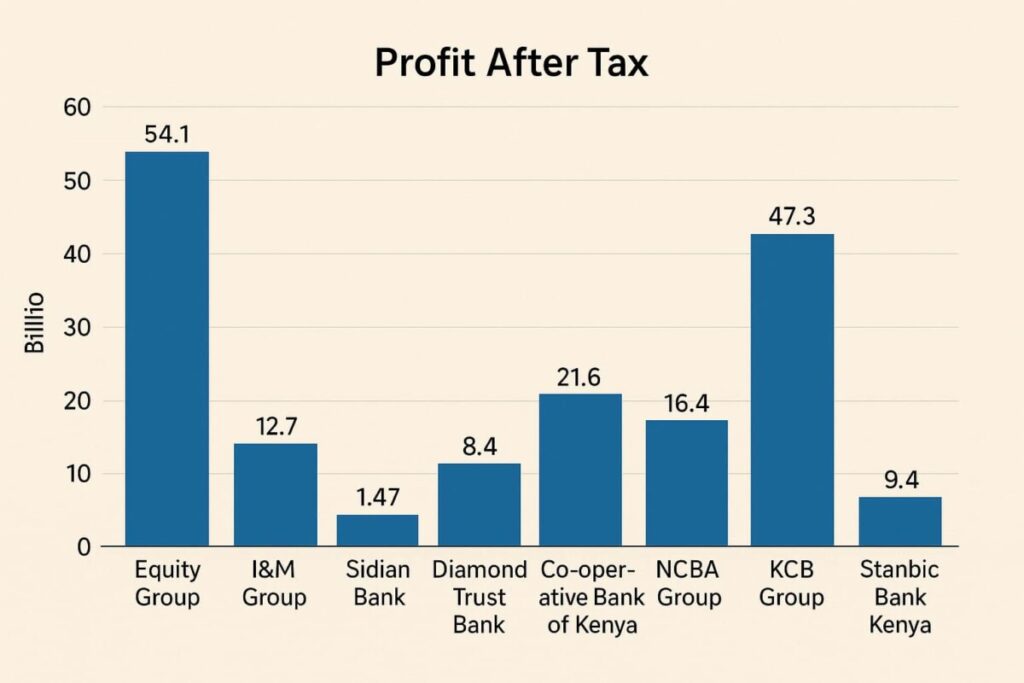

Profit After Tax

Equity Group led in profitability with a 32% rise to KES 54.1 billion, I&M Group grew 27% to KES 12.7 billion, while Sidian Bank surged 470% to KES 1.47 billion.

Diamond Trust Bank profits increased 12.3% to KES 8.4 billion, Co-operative Bank of Kenya rose 12.3% to KES 21.6 billion, NCBA Group grew 8.5% to KES 16.4 billion, and KCB Group edged up 3% to KES 47.3 billion. Stanbic Bank Kenya reported a decline, with profit falling 7.5% to KES 9.4 billion.

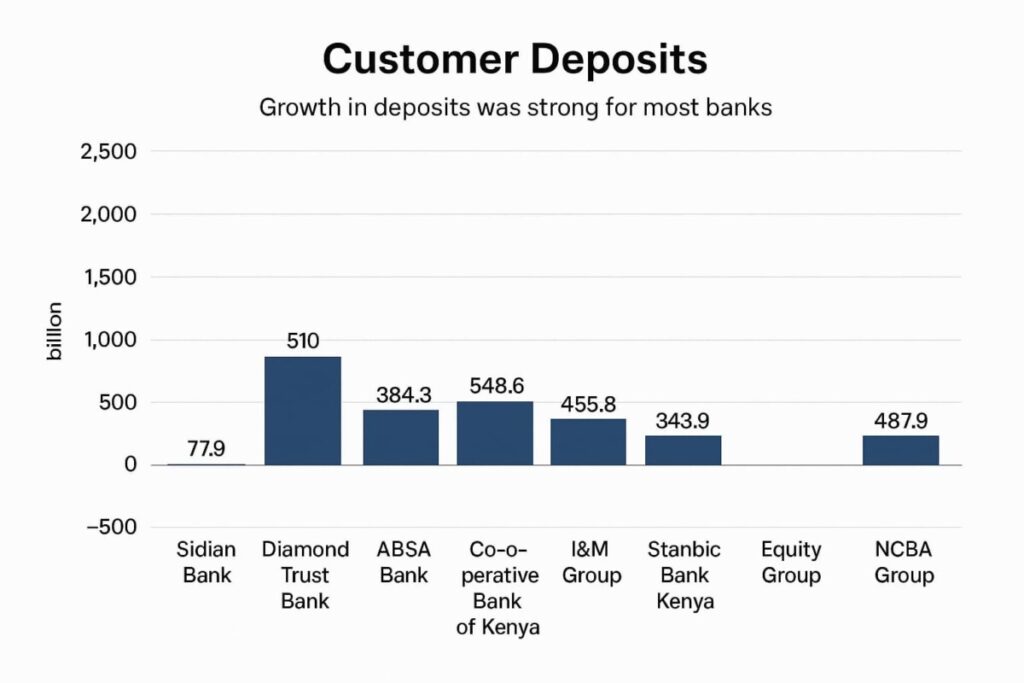

Customer Deposits

Growth in deposits was strong for most banks. Sidian Bank led with a 79% rise to KES 77.9 billion, Diamond Trust Bank increased 15.4% to KES 510 billion, ABSA Bank rose 9.2% to KES 384.3 billion, Co-operative Bank of Kenya grew 6.7% to KES 548.6 billion.

I&M Group’s deposits were up 10% to KES 455.8 billion, Stanbic Bank Kenya increased 4.8% to KES 343.9 billion, and Equity Group saw deposits remain stable within overall asset growth. KCB Group reported a 1% decline to KES 1.5 trillion, while NCBA Group deposits fell 5.2% to KES 487.9 billion.

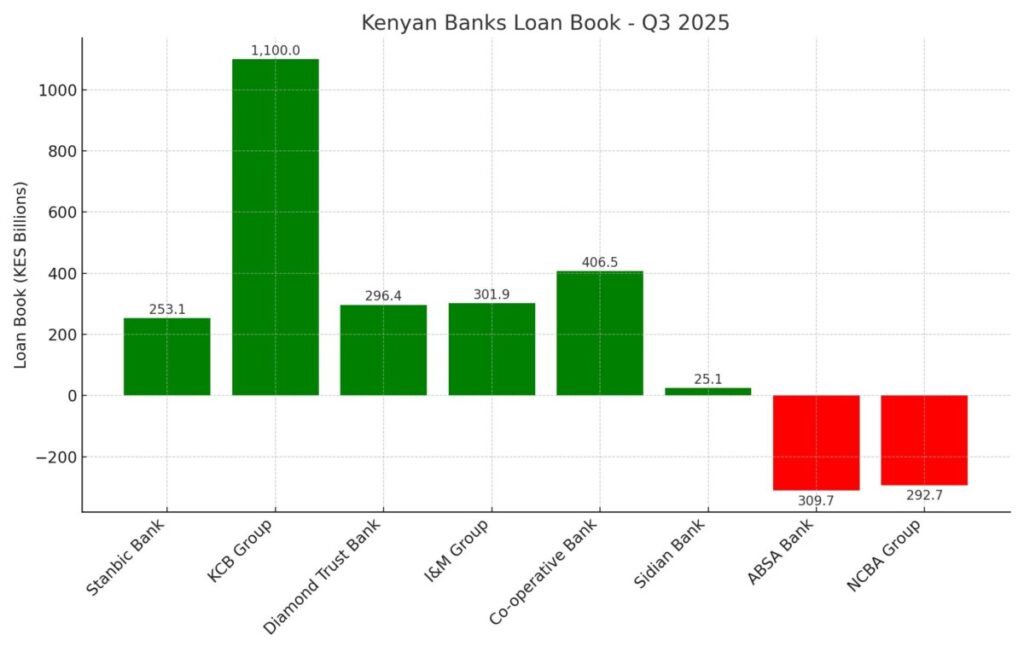

Loan Book

Stanbic Bank Kenya posted the highest loan book growth at 15.7% to KES 253.1 billion, KCB Group grew 8% to KES 1.1 trillion, Diamond Trust Bank rose 7.7% to KES 296.4 billion, I&M Group increased 7.3% to KES 301.9 billion, and Co-operative Bank of Kenya rose 6.6% to KES 406.5 billion.

Sidian Bank recorded marginal growth of 0.4% to KES 25.1 billion. ABSA Bank’s loans declined 0.6% to KES 309.7 billion, while NCBA Group eased 3.5% to KES 292.7 billion.

Net Interest Income

Net interest income was strong across most lenders. I&M Group recorded a 21.1% increase to KES 31.8 billion, NCBA Group rose 22% to KES 32 billion, KCB Group increased 12% to KES 104.3 billion, Diamond Trust Bank grew 18% to KES 25 billion, Stanbic Bank Kenya rose 8% to KES 20.5 billion, Sidian Bank surged 55% to KES 2.7 billion, and Equity Group increased 16%. ABSA Bank, however, reported a 4.6% decline to KES 33 billion.

Non-Interest Income

Non-interest income saw mixed performance, with several banks recording declines. Stanbic Bank Kenya’s non-interest income dropped 24.5% to KES 7.8 billion, KCB Group fell 10% to KES 45.1 billion, Diamond Trust Bank declined 5.8% to KES 9.1 billion, and NCBA Group decreased 2% to KES 21.4 billion. Sidian Bank saw the highest growth of 146% to KES 2.9 billion, ABSA Bank increased 11.2% to KES 13.6 billion, and I&M Group rose 18% to KES 11.2 billion.

Loan Loss Provisions

Provisions for loan losses increased for some banks, Sidian Bank rising 127% to KES 1 billion, NCBA Group up 24% to KES 5.1 billion, Diamond Trust Bank increased 7.6% to KES 5.7 billion, KCB Group up 3% to KES 18.3 billion, and I&M Group dropped 7% to KES 33.1 billion in NPLs. ABSA Bank reduced provisions by 39.6% to KES 4.8 billion, while Stanbic Bank Kenya saw a 6.6% decline to KES 2.5 billion.

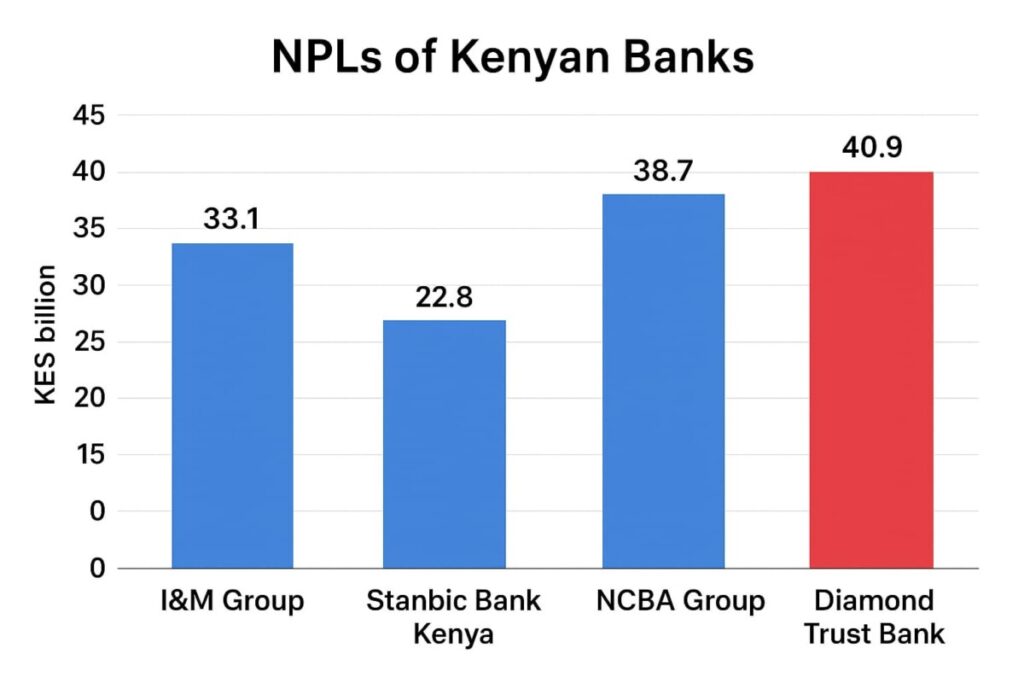

Non-Performing Loans (NPLs)

I&M Group’s NPLs fell 7% to KES 33.1 billion, Stanbic Bank Kenya decreased 8% to KES 22.8 billion, and NCBA Group reduced NPLs by 6% to KES 38.7 billion. Diamond Trust Bank recorded a 4.5% increase to KES 40.9 billion.

Dividends

I&M Group declared an interim dividend of KES 1.50 per share, up from KES 1.30 last year, amounting to KES 2.61 billion. Payment is scheduled for mid-January 2026.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.