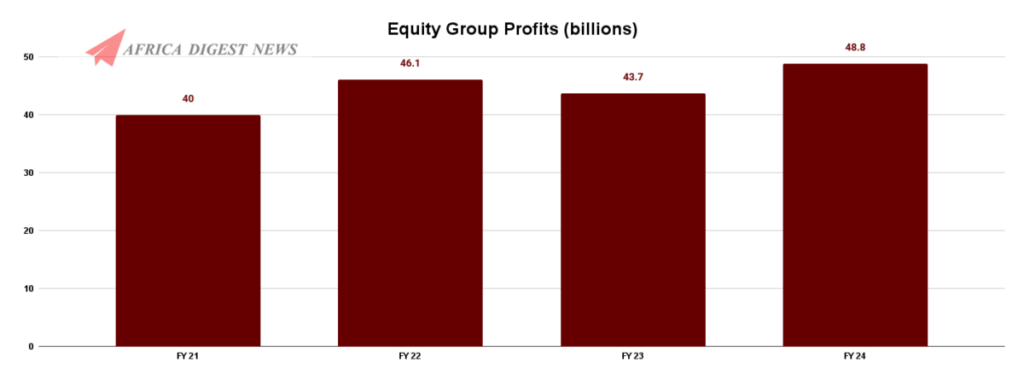

Equity Group’s net profit for the 2024 financial year rose by 11.6% to Sh 48.8 billion, with the bank declaring a dividend of Sh 4.25 per share, up from Sh 4.00 in the previous year.

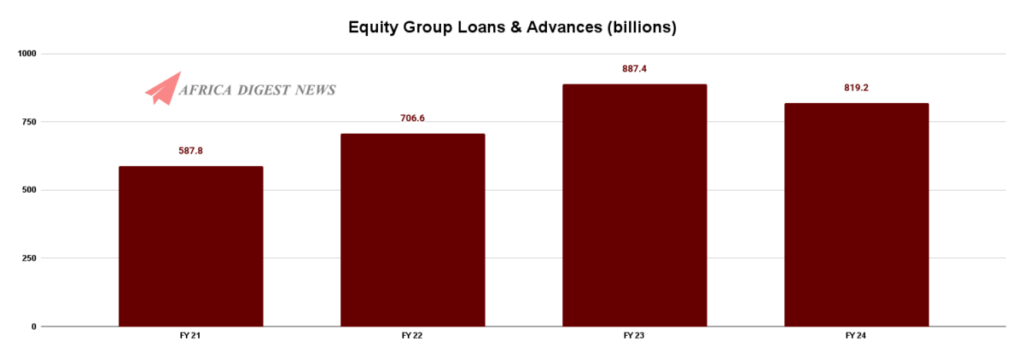

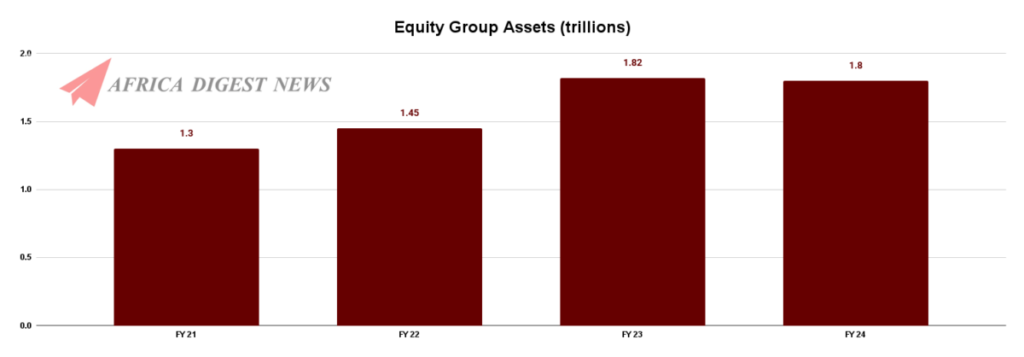

The Group’s total assets edged up by 1% to Sh 1.8 trillion, while customer deposits stood at Sh 1.4 trillion. Loans and advances grew to Sh 819.2 billion. Interest income from loans and advances hit Sh 107.7 billion, while earnings from government securities reached Sh 56.5 billion. As a result, net interest income rose by 3.7% to Sh 108.7 billion.

“Equity Bank Kenya has in the past six months cut its base lending rate three times sending a clear signal of its intent to grow its loan book as the Kenya’s economy shows signs of recovery. The lowering of interest rates will reduce the cost of borrowing, offering businesses access to more affordable credit while for households it means increased disposable income thus stimulating consumer spending.” Equity Group Managing Director and CEO Dr. James Mwangi commented on this trend.

Read: Equity Bank Reduces Lending Rates Following CBK Rate Cut

Despite a 6.5% increase in gross non-performing loans (NPLs) to Sh 121.9 billion, the bank maintained a solid asset quality. “The Group’s Non-Performing Loan (NPL) ratio remained below industry average at 12.2%, significantly lower than the 16.4% published industry average. NPL coverage stands at 71%, reinforcing the Group’s strong asset quality.” Dr. Mwangi noted.

Provisions for loan losses dropped sharply by 43.3% to Sh 20.2 billion. Additionally, Equity’s regional subsidiaries contributed 49% of total assets and 54% of profit before tax.

“The Group’s strategic focus on regional expansion and product diversification continues to drive growth with the Group’s regional subsidiaries contributing 49% of total assets, 48% of total loans and 54% of profit before tax, further diversifying the revenue base.” Dr. Mwangi noted.

Equity’s digital banking growth was another highlight of the year, with mobile transactions via the Equity Mobile App and *247# recording a 67% surge in value. “Instability of our systems is something of the past. We are very excited and despite some challenges, our transaction fees last year went up by 67% because the systems are stable.” said Dr. Mwangi.

Read: Equity Bank Uganda Appoints New Managing Director

Beyond banking, the Group continues to expand its footprint in healthcare through Equity Afya, which has grown from five medical centers to 132, covering all counties in Kenya. “We’re working closely with our Insurance arm to ensure that our customers are able to access quality, affordable medical care without strain.” said Dr. Joanne Korir, Director of Operations at Equity Group Foundation.

“We are steadily advancing towards universal healthcare in a structured and sustainable manner. Our business model is designed to shield our customers from the financial strain of costly medical care.” she added.

Equity Health Insurance is also playing a role in this expansion, offering a flexible and personalized approach to health coverage. “Rather than a one-size-fits-all policy, we provide tailor-made insurance solutions designed to meet the unique needs of each customer.” said Dr. Patrick Gatonga, Managing Director of Health Insurance at Equity Group Insurance Holdings.

Looking ahead, the bank remains optimistic about continued growth in 2025. “We are optimistic that this year we grow our loans by between 10 and 15%, and deposits between 10 and 15%. And we’ll test this in the first quarter, which we will be reporting in just about a month’s time.” Dr. Mwangi stated.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.