Kenya’s two largest lenders, KCB Bank Group and Equity Group, have delivered record-breaking half-year results, cementing their dominance in East Africa’s banking sector. Both posted strong earnings growth, expanded regional operations, and strengthened balance sheets, but their H1 2025 performances reveal distinct areas of leadership.

Profitability

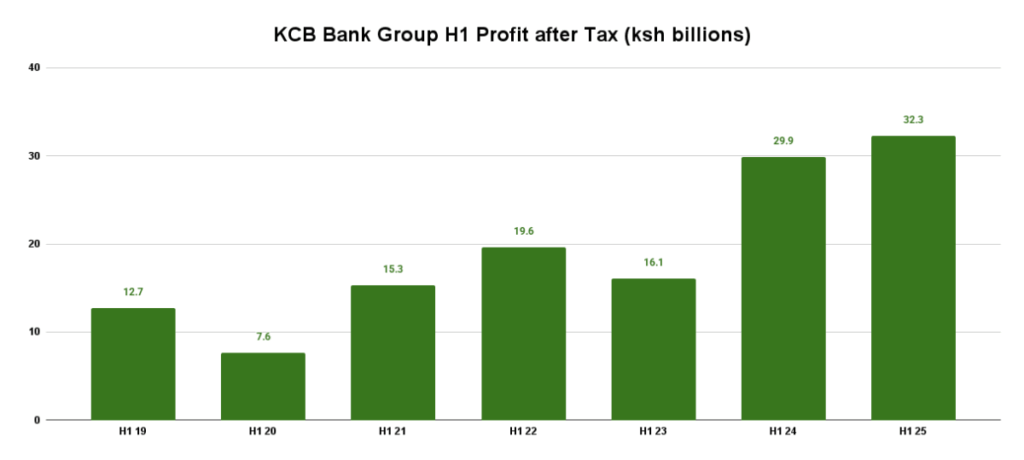

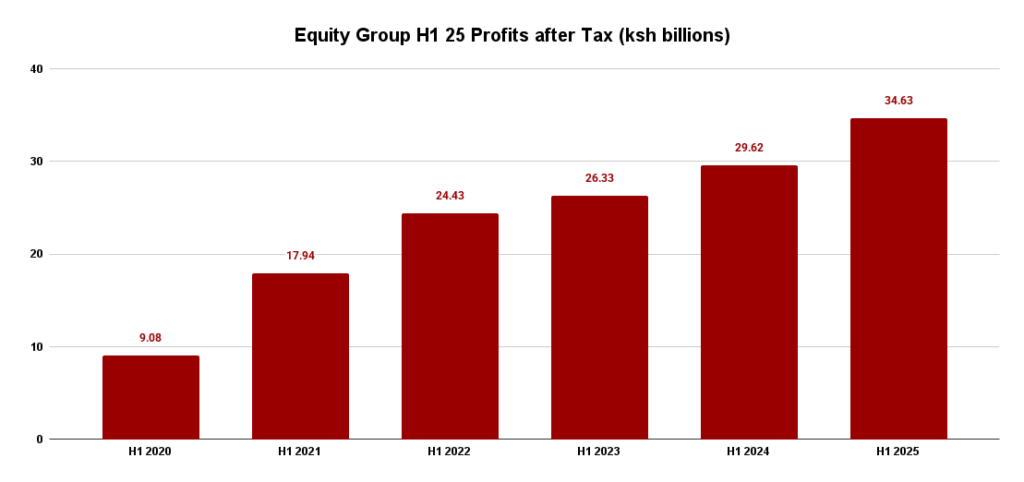

In KCB H1 25 results, net profit rose 8% to KSh 32.3 billion, supported by steady asset growth, improved cost management, and increased contributions from non-banking subsidiaries. In contrast, Equity H1 25 saw profit after tax jump 17% to KSh 34.6 billion, with profit before tax at KSh 41.5 billion, up from KSh 35.1 billion in H1 2024.

Equity Bank’s profitability surge was driven by a 9% increase in net interest income, an 18% reduction in interest expenses, and a 34% fall in loan loss provisions. KCB Bank’s growth was supported by a 4.3% rise in total revenue to KSh 98.6 billion, with net interest income climbing to KSh 69.1 billion and non-funded income reaching KSh 29.5 billion.

Shareholder Returns and Capital Strength

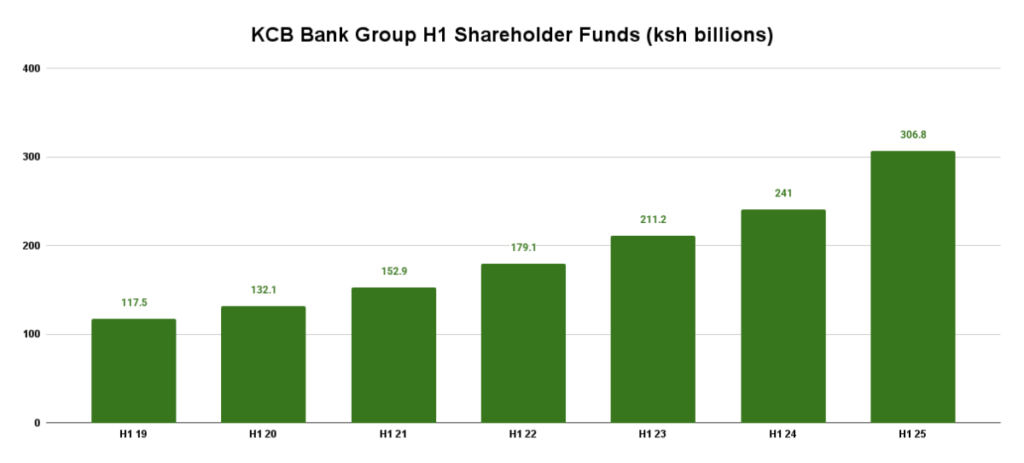

KCB Bank Group announced its largest-ever interim payout, totaling KSh 13 billion, split between an interim dividend of KSh 2.00 per share and a special dividend of KSh 2.00 per share. The special dividend was linked to the sale of the National Bank of Kenya. KCB also became the first bank in East and Central Africa to surpass KSh 300 billion in shareholder funds, closing H1 2025 at KSh 306.8 billion.

Equity Group surpassed $2 billion in shareholder funds, reaching KSh 261.9 billion, a 24.1% increase compared to the same period in 2024. Earnings per share rose 16% to KSh 8.8. Its capital position remained strong, with a core capital to risk-weighted assets ratio of 16.5% and total capital ratio of 18.1%, compared to KCB Bank’s core capital ratio of 17.0% and liquidity ratio of 47.2%.

Regional Contribution

KCB and Equity both expanded regional operations, but Equity H1 25 reported a higher contribution from subsidiaries. Regional businesses accounted for 50% of the Group’s loan book, deposits, and banking revenue. KCB’s regional subsidiaries contributed 33.4% of profit before tax and 31.4% of the balance sheet.

Equity Bank’s subsidiary growth was notable, Tanzania led with a 75% profit rise, followed by Uganda at 40% and the DRC at 22%. Rwanda posted the highest return on assets at 4.1% and a return on equity of 29.6%. KCB’s regional network continued to grow, with digital transactions accounting for 99% of customer activity across subsidiaries.

Balance Sheet and Lending

KCB H1 25 closed with total assets of KSh 1.9 trillion, a loan portfolio of KSh 1.09 trillion, and customer deposits at KSh 1.48 trillion. Equity Group’s total assets rose 3% to KSh 1.8 trillion, with net loans at KSh 825.1 billion and customer deposits at KSh 1.32 trillion.

While KCB holds a larger asset base, Equity recorded a stronger loan-to-deposit ratio of 62.5% compared to KCB’s 79.7% when excluding NBK’s exit-adjusted loan growth.

Diversification Beyond Banking

Equity H1 25 results highlight diversification into insurance, with its life, general, and health divisions growing rapidly. Gross written premiums rose 115% to KSh 5.18 billion, with insurance assets increasing by 40%. KCB Bank Group’s non-banking contributions came from KCB Investment Bank, KCB Asset Management, and KCB Bancassurance, which helped offset a softer foreign exchange environment.

Operational Efficiency

KCB’s operational costs rose just 2.4%, keeping the cost-to-income ratio at 46.0%. Equity’s cost-to-income ratio was lower in key markets, such as Rwanda at 35.8%, while also benefiting from reduced provisioning expenses.

Regulatory Wins

Both banks secured exemptions from the Democratic Republic of Congo’s “Instruction 18” ownership rule, allowing KCB Bank to retain its 85% stake in Trust Merchant Bank and Equity Group to maintain its 85.4% stake in EquityBCDC.

Digital Transformation

KCB H1 25 introduced a unified mobile app integrating AI, instant onboarding, and mini-app services, contributing to 99% digital transaction volumes. Equity’s digital banking figures were not disclosed for the half-year, but its regional performance suggests strong uptake of digital services.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.