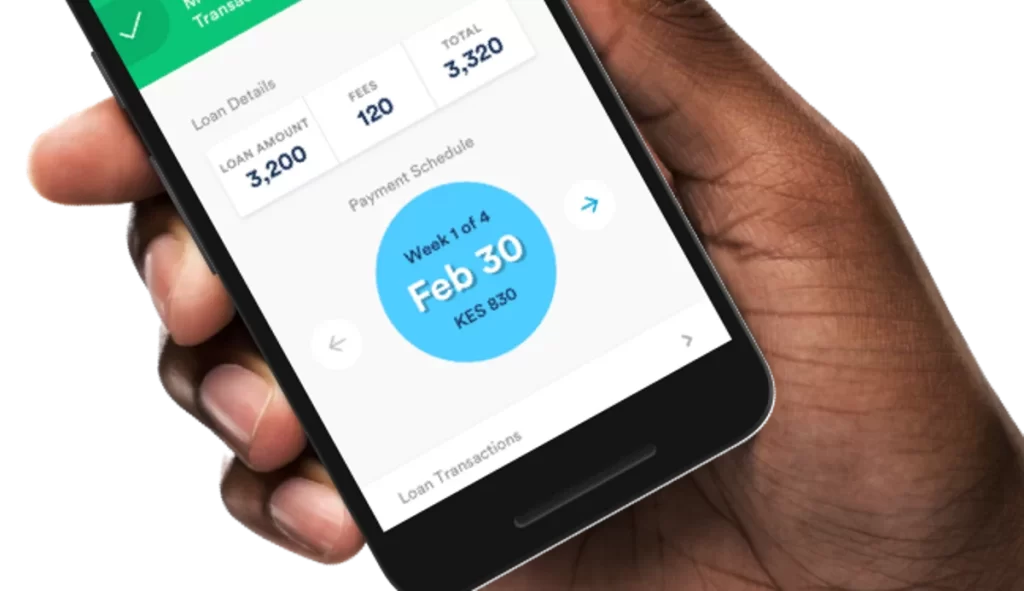

Digital credit has transformed financial inclusion in Kenya, giving millions of people quick access to loans through mobile apps and online platforms. The movement began with innovations like M-Shwari in 2012, which demonstrated how mobile technology could extend credit to those outside traditional banking. Yet, the industry’s rapid expansion also introduced challenges: predatory lending, harassment of borrowers, and breaches of personal data.

To address these risks, the Central Bank of Kenya (CBK) stepped in with new regulations. Today, operating as a Licensed Digital Credit Provider (DCP) in Kenya is no longer optional, it is a legal requirement that reshapes how the sector functions. Being licensed signals recognition by CBK as a regulated financial intermediary, accountable to strict oversight, consumer protection rules, and ethical business practices.

Defining a Digital Credit Provider and the Licensing Requirement

A Digital Credit Provider (DCP) is defined as any individual, company, or partnership offering credit facilities through digital channels such as mobile apps, online platforms, or computer-based systems. However, this definition excludes banks, SACCOs, microfinance institutions, and buy-now-pay-later services for goods and services, which are regulated under different laws.

The CBK (Digital Credit Providers) Regulations, 2022, introduced under the Central Bank of Kenya (Amendment) Act, 2021, require that no entity can offer digital credit without a CBK license. Existing digital lenders were given until September 17, 2022, to apply, while new entrants must secure approval before launching.

Operating without a license is a criminal offense. Penalties include up to three years in prison, a fine of KES 5 million, or both. This law eliminated the unregulated “wild west” of digital lending and created a system where only compliant providers can operate.

Licensing also gives borrowers confidence that the lender follows national standards, lowering the risks of hidden charges or abusive recovery practices. As of September 2025, CBK has licensed 153 Digital Credit Providers. For these CBK licensed digital lenders in Kenya, compliance unlocks critical benefits such as partnerships with telecom operators like Safaricom, access to Credit Reference Bureaus (CRBs), and eligibility to list apps on Google Play and other platforms that delisted non-compliant lenders in 2022.

Steps Involved in Getting a DCP License in Kenya

The licensing process unfolds in four main stages:

1. Name Approval

Applicants must first submit their proposed business name to CBK for reservation. This step prevents duplication and ensures that the entity is entering the market for genuine digital lending purposes. An affidavit and a small fee are required.

2. Pre-Application Briefing

Applicants present a detailed business plan that outlines their funding sources, target markets, risk management strategies, and technology setup. CBK reviews the plan for anti-money laundering (AML) compliance and capital adequacy. For companies, a minimum paid-up capital of KES 50 million is mandatory. Directors and shareholders must complete “fit-and-proper” declarations, supported by police clearance and financial history checks.

3. Formal Application

This is the most rigorous stage, requiring:

- Incorporation documents and governance policies (e.g., board charters and codes of ethics).

- Agreements with telecom companies for loan disbursements.

- Data protection policies that comply with the Data Protection Act, 2019.

- Dispute resolution frameworks for customers.

- Proof of strong cybersecurity systems and customer onboarding processes using e-KYC.

- Integration with CRBs such as TransUnion and Metropol for credit reporting.

- CBK evaluates the application within 60 days, with the option to request clarifications or additional documents.

- Data Submission and Approval

Before final approval, applicants must run a “dry test” of their systems by submitting regulatory data to CBK. This tests the lender’s ability to meet reporting requirements. If the systems meet expectations, CBK grants the license upon payment of a KSh 20,000 fee. The license is valid for 12 months and must be renewed annually by December 31. Renewal applications are due three months in advance and depend on compliance audits and performance metrics.

Obligations of a Licensed DCP

Being a licensed DCP is not a one-time achievement. Licensed entities must continually meet CBK’s regulatory and ethical standards.

- Corporate Governance: At least one-third of the board must consist of independent directors. Annual audits are mandatory, and providers must submit quarterly reports on loan portfolios, default rates, and customer complaints.

- Transparency: All loan agreements must disclose interest rates, fees, and penalties clearly and upfront. The “in duplum rule” applies, which is when a loan becomes non-performing, the recoverable amount cannot exceed the principal, plus equivalent interest and reasonable recovery costs.

- Consumer Protection: Licensed DCPs cannot harass defaulters. Practices such as threats, abusive language, or contacting family and friends without consent are prohibited. Instead, lenders must offer humane recovery processes, including options for restructuring loans.

- Data Privacy and Credit Reporting: Compliance with the Office of the Data Protection Commissioner (ODPC) guidelines is mandatory. Borrowers’ consent is required for credit scoring, and negative CRB listings must be justified. Licensed DCPs must participate in Credit Information Sharing to ensure that both positive and negative borrower histories are captured.

Why Licensing Matters

Becoming a licensed DCP in Kenya means more than ticking regulatory boxes. It is a formal commitment to fair lending, transparency, and consumer rights. For borrowers, it provides protection from the exploitative practices that once dominated the digital lending space. For lenders, it builds credibility, enables partnerships, and opens the door to sustainable growth in a competitive market. With 153 licensed DCPs now active, Kenya’s digital lending sector has entered a new phase where CBK licensed digital lenders in Kenya are held to high standards.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.