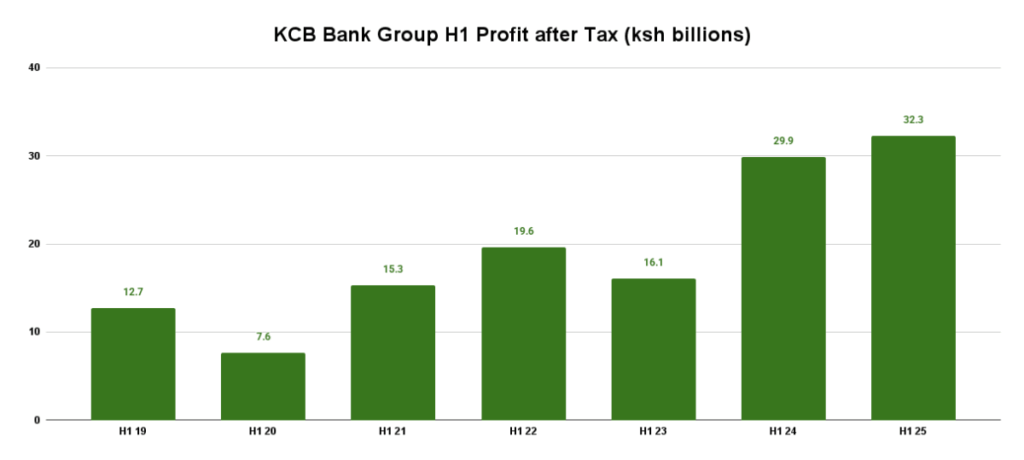

KCB Bank Group has posted an 8% rise in net profit for the first half of 2025, reaching KSh 32.3 billion. The results, driven by steady asset growth, regional diversification, and customer-focused innovations, have paved the way for the lender’s largest-ever interim payout and its first special dividend.

The KCB Group H1 25 financials, released on Wednesday, show that the Board has approved a KSh 13 billion distribution to shareholders, split between an interim dividend of KSh 2.00 per share and a special dividend of KSh 2.00 per share. The special payout is linked to the sale of the National Bank of Kenya (NBK). The combined KSh 4.00 per share will be paid on or about 11 November 2025.

“This is split between KSh 2 for the interim and KSh 2 special out of the sale of NBK. All that amounts to a payout of just under KSh 13B,” the Group’s Chief Financial Officer said. “I think that’s the largest interim dividend that KCB has ever paid.”

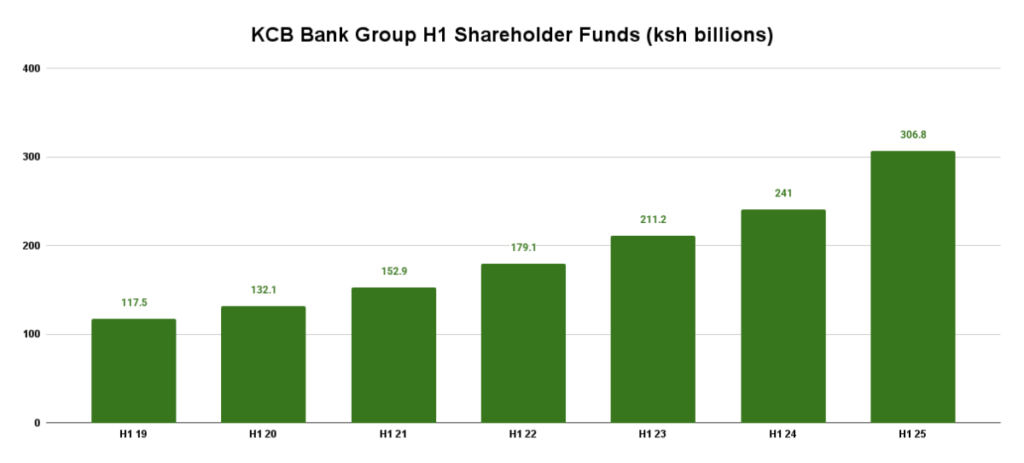

Stronger capital position and shareholder value

By 30 June 2025, KCB Bank Group had become the first bank in East and Central Africa to surpass KSh 300 billion in shareholder funds, reaching KSh 306.8 billion. The milestone coincided with the bank’s share price touching a 52-week high of KSh 50.

KCB Group Chairman Dr. Joseph Kinyua said the performance provided the capacity to return value to investors while supporting long-term growth. “The strong half-year performance and the projected trajectory of the business has allowed us a great bandwidth to propose a historic special and interim dividend to shareholders,” he said, noting that KCB subsidiaries across the region made solid contributions to the results.

KCB Group Chief Executive Officer Paul Russo said the business remained resilient despite economic pressures in some key markets, including Kenya. “Despite this, we have placed our customers at the fore, to ensure we meet their needs in a timely manner,” he said.

Performance drivers

The Group’s earnings were supported by growth in its asset base, steady cost management, and improved contributions from non-banking units such as KCB Investment Bank, KCB Asset Management, and KCB Bancassurance.

KCB total revenue rose 4.3% year-on-year to KSh 98.6 billion, with net interest income increasing to KSh 69.1 billion on the back of higher yields and loan volumes. Non-funded income reached KSh 29.5 billion, accounting for 29.9% of total revenue despite a softer foreign exchange environment.

- What Drove Equity Group’s Strongest Quarter in History

- How Absa Bank Kenya Achieved 9% Profit Growth in H1 2025 Despite Market Challenges

- Stanbic Bank Kenya Tax Profits Fall by 9% to Ksh 6.5 Billion in H1 2025

The KCB loan portfolio stood at KSh 1.18 trillion, up 2.8% overall, or 12% when excluding NBK’s exit. Customer deposits closed the half-year at KSh 1.48 trillion, maintaining strong liquidity levels.

Operational costs rose just 2.4%, keeping the cost-to-income ratio stable at 46.0%. The KCB Group non-performing loan (NPL) ratio improved to 18.7% from 19.2%. Capital and liquidity buffers remained well above statutory requirements, with a core capital ratio of 17.0% and a liquidity ratio of 47.2%.

Digital growth and regional contributions

KCB subsidiaries outside Kenya contributed 33.4% of profit before tax and 31.4% of the balance sheet. Digital transactions accounted for 99% of customer activity. The Group’s new unified mobile app, launched in August, integrates artificial intelligence, instant self-onboarding, and a mini-app ecosystem to enhance convenience.

The number of KCB customers stood at 32 million, comprising 9 million conventional banking clients and 23 million digital users. The physical and partner network included 1.3 million agents and merchants, 11,191 employees, number of KCB ATMs at 1,224 (691 KCB ATMs and 533 partner ATMs), and number of KCB branches at 455.

Sustainability and social investment

During KCB H1 25, the bank advanced KSh 26.9 billion in green loans and screened KSh 133.2 billion in credit facilities for environmental and social compliance. Community investments spanned sports, education, and development projects. The Group also continued to attract international recognition for corporate responsibility and ESG leadership.

Outlook

Dr. Kinyua said that with robust capital, a diverse regional footprint, and continued investment in digital platforms, the Group is well-positioned for the remainder of 2025. Russo added that the focus will remain on strengthening customer relationships, enhancing operational resilience, and leveraging regional opportunities.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.