When Safaricom Limited entered Ethiopia in 2022, it was clear the journey would not be easy. The Kenyan telecom giant took on a high-risk market, one with over 130 million people, long dominated by state-owned Ethio Telecom, and marked by civil unrest, high inflation, and strict regulation. Yet, despite recording heavy losses in its latest financial year, Safaricom Ethiopia is showing remarkable growth across key metrics, including subscribers, data usage, and mobile money adoption.

Billions Invested, Millions Lost

For the financial year ending March 2025, Safaricom Ltd reported losses of US$325 million (KSh 42 billion) against total revenue of just US$53.6 million (KSh 6.9 billion). These losses were largely driven by capital-intensive investments as the company built a new network from scratch. Covering Ethiopia’s vast and mountainous terrain has required enormous spending on mobile towers, fiber optic networks, and spectrum.

By mid-2025, Safaricom in Ethiopia had invested more than US$850 million in infrastructure, and by August that figure had grown to around US$2.2 billion. The company also faces recurring costs, including US$3 million annually paid to Ethio Telecom for infrastructure rentals.

Security challenges in Oromia and Amhara regions delayed several site builds, while hyperinflation (peaking at around 30-35% in the 2022-2023) and currency depreciation inflated costs further. Regulatory issues also played a role, with the World Bank noting disputes over fair access to fiber and pricing models that favor the incumbent operator.

Even so, the numbers are starting to shift. Service revenue grew 65% year-on-year to KSh 8.9 billion in the first half of FY2025, while operating losses narrowed as the network gained scale. Analysts expect the company to halve its losses in the current fiscal year and break even by FY2027.

Explosive User Growth

Safaricom’s aggressive rollout is paying off. From zero customers at launch, Safaricom Ethiopia had 7.1 million 90-day active customers by January 2025, a 64% increase from the previous year, and surpassed 10 million by July 2025. That gives it roughly a 5.5% market share in under three years, a strong start for a newcomer in a previously closed market.

Mobile data users now total 4.37 million, representing a 141% year-over-year increase. Data has quickly become the company’s main revenue driver, accounting for 72% of total income and over 80% of mobile service revenue. Average monthly data usage per customer has jumped to 6.7 GB, higher than Kenya’s 5.5 GB.

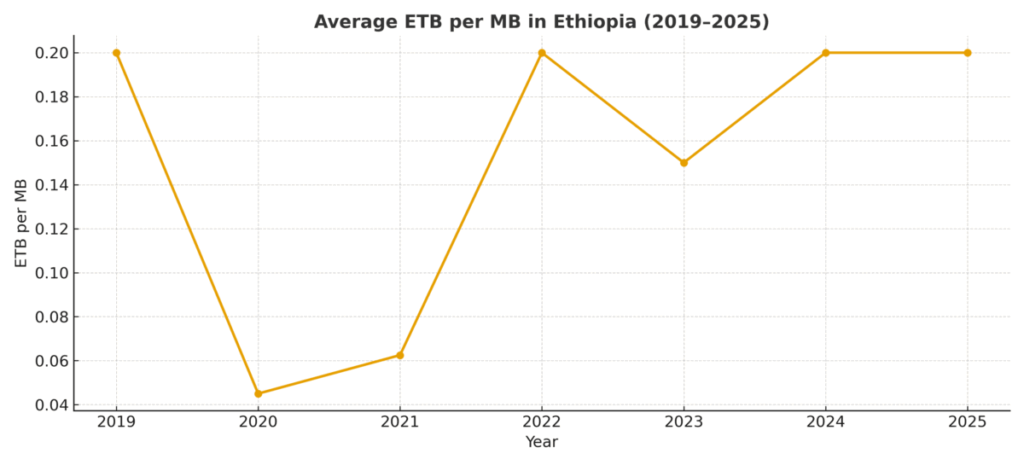

This rapid growth has been fueled by affordable data bundles and a growing appetite for internet services. Since Safaricom Limited began operations, mobile data prices in Ethiopia have dropped dramatically, by as much as 70% since 2017, to as low as ETB 0.20 per MB. As a result, the number of broadband subscribers nationwide has more than doubled from 50 million in 2022 to 87 million by mid-2025, with projections to reach 112 million by 2028.

Infrastructure and Network Expansion

Safaricom’s infrastructure investments are transforming Ethiopia’s connectivity landscape. By December 2024, the company had deployed 3,101 base stations, a 38% increase from the previous year, achieving 48.5% 4G population coverage, meeting its license obligations ahead of schedule.

Fiber optic rollout began in mid-2025, targeting major cities such as Addis Ababa, Dire Dawa, and Hawassa. This has pushed Ethiopia’s 4G coverage from below 20% in 2022 to nearly 50%, enabling faster streaming, e-learning, and video conferencing. By the end of FY2025, Safaricom plans to operate 3,300 base stations and expand coverage to 55% of the population.

These developments have helped Ethiopia’s ICT sector grow rapidly, contributing around 2% of the country’s GDP. The increased competition has also forced Ethio Telecom to lower its tariffs and improve network quality, benefiting consumers nationwide.

The M-Pesa Revolution in Ethiopia

A major advantage for Safaricom has been its mobile money platform, M-Pesa Safaricom. Launched in Ethiopia in 2023, the service had 2.4 million active users by May 2025, processing transactions worth KSh 20.6 billion. In a country where only about 35% of the population has access to a bank account, M-Pesa has become an entry point into formal financial services.

The introduction of M-Pesa Safaricom has enabled digital remittances, bill payments, and merchant transactions in a largely cash-based economy. Cross-border remittances between Kenya and Ethiopia went live in October 2024, tapping into Ethiopia’s annual diaspora inflows estimated at USD 5–6 billion. Merchant transactions tripled year-over-year as more small businesses adopted the platform.

This financial inclusion drive is reshaping Ethiopia’s payments ecosystem, with M-Pesa enabling everything from peer-to-peer transfers to e-commerce growth. Unlike Ethio Telecom, which only recently launched its own wallet, Safaricom’s experience in fintech gives it a clear competitive edge.

Local Employment and Economic Impact

Safaricom Ethiopia has also had a notable impact on job creation. The company employs over 900 people directly, 97% of whom are Ethiopian nationals, and has created over 20,000 indirect jobs through agents, distribution partners, and subcontractors.

Beyond employment, Safaricom Ethiopia’s network expansion has generated new opportunities for logistics providers, device retailers, and local construction firms. It has also supported youth-led startups and digital entrepreneurs, particularly in urban centers such as Addis Ababa.

Long-Term Outlook

While the early financials remain challenging, Safaricom Limited appears firmly on track for sustainable growth in Ethiopia. The foundation is in place: strong subscriber growth, a rapidly expanding data business, and a thriving M-Pesa Safaricom ecosystem.

Safaricom CEO Peter Ndegwa has projected that the Safaricom Group could reach 70 million subscribers by 2030, driven by the Ethiopian expansion and 5G network upgrades.

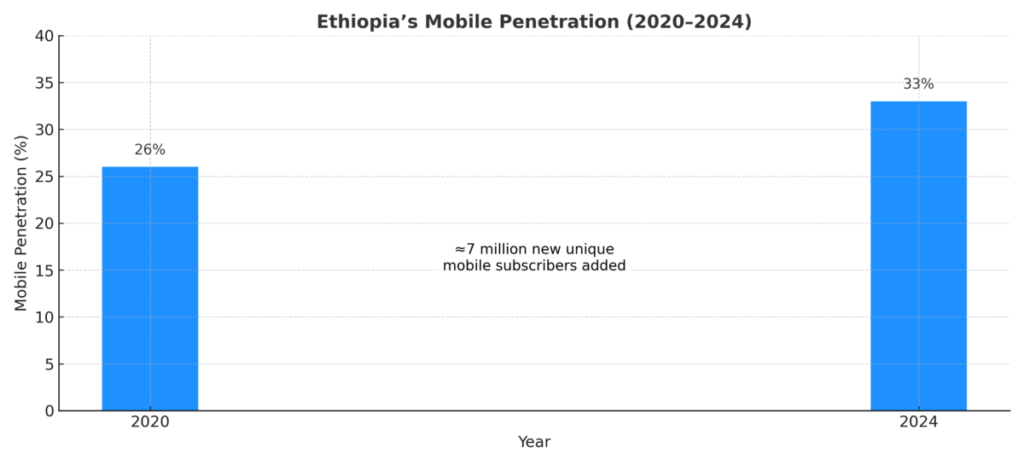

Ethiopia’s mobile penetration rate, once below 40%, is now surging, and with over 130 million people, 70% of whom live in rural areas, the growth potential remains immense.

Despite reporting hundreds of millions in losses, Safaricom’s early progress tells a different story: one of scale, impact, and transformation. With a strong network, fast-growing user base, and fintech-driven financial inclusion, Safaricom Ethiopia is laying the groundwork for what could become East Africa’s most influential telecom expansion in the next decade.

Jefferson Wachira is a writer at Africa Digest News, specializing in banking and finance trends, and their impact on African economies.